Key Questions to Ask When Buying a Home

Navigating the home-buying process can be daunting, but asking the right questions can make all the difference. In this comprehensive guide, we explore essential Buyer FAQ; Questions to Ask, ensuring that you are well-informed before making one of the most significant investments of your life. In collaboration with lending expert Jacob Studdard, we provide insights that will help you navigate this journey smoothly.

Table of Contents

- Buying A Home

- Importance of Relationships in Real Estate

- People Involved in Real Estate

- How much money do I need to purchase a home?

- What is the first step in buying a home?

- What credit score do I need to buy a home?

- Where Jacob and I currently are?

- Can you use your VA loans more than once?

- Common Misconceptions About Closing Costs

- FAQ Section

Buying A Home

Buying a home is one of the most significant decisions you will ever make. It's not just about finding a house; it's about building relationships and navigating a complex process. This guide will walk you through essential aspects of home buying, including financial requirements, critical first steps, and the importance of understanding your credit score. By having the right knowledge and asking the right questions, you can ensure a smoother home-buying experience.

Importance of Relationships in Real Estate

In real estate, relationships are everything. The process of buying or selling a home involves various parties, including agents, lenders, appraisers, and inspectors. Each of these players contributes to the transaction, and having strong relationships can make all the difference.

- Communication: Effective communication between all parties ensures everyone is on the same page, reducing the risk of misunderstandings or delays.

- Trust: Building trust with your real estate agent and lender can provide peace of mind, knowing they have your best interests at heart.

- Guidance: Experienced agents and lenders can guide you through the process, helping you avoid common pitfalls.

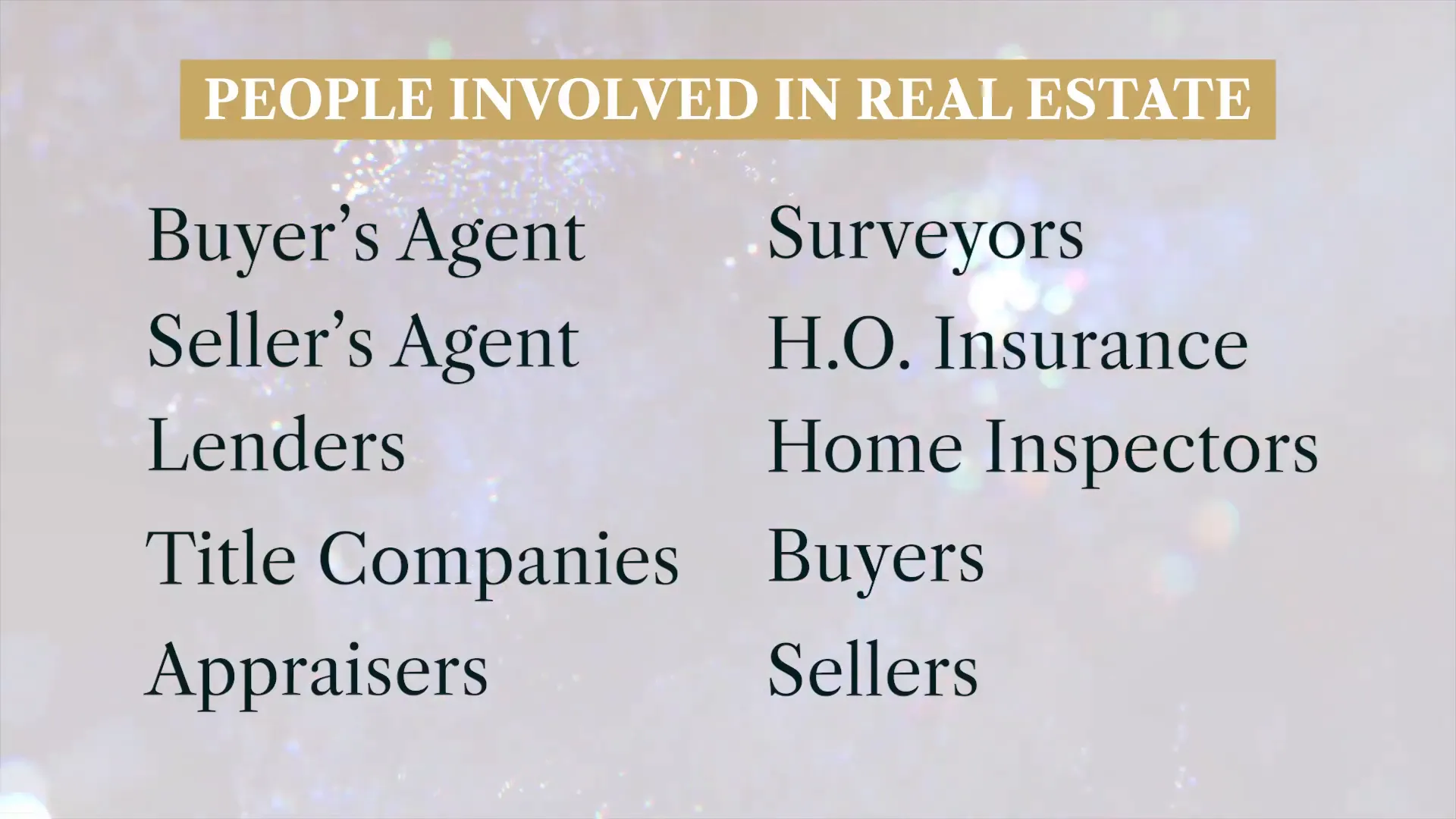

People Involved in Real Estate

Understanding who is involved in the home-buying process is crucial. Here’s a breakdown of the key players:

- Buyer's Agent: Represents your interests and helps you find the right home.

- Seller's Agent: Represents the seller and manages the listing and negotiation process.

- Lenders: Provide financing options for your home purchase.

- Title Companies: Handle the legal aspects of the transaction, ensuring the title is clear.

- Appraisers: Assess the property's value to ensure it aligns with the purchase price.

- Surveyors: Measure the property boundaries and assess land conditions.

- Homeowners Insurance Agents: Provide insurance coverage to protect your investment.

- Home Inspectors: Evaluate the condition of the home to identify any potential issues.

- Buyers: The individuals or families looking to purchase a home.

- Sellers: The individuals or families selling their property.

How much money do I need to purchase a home?

One of the most common questions among potential home buyers is about financial readiness. The amount of money you need can vary significantly based on the type of loan you choose.

Typically, you will need to consider both the down payment and closing costs:

- Down Payment: This is usually a percentage of the home's purchase price. For example, on a $400,000 home, you might need between 3% to 5%, which translates to $12,000 to $20,000. However, specific loan programs like VA loans can allow for zero down payment.

- Closing Costs: These are fees associated with the purchase, which can range from 2% to 3% of the home's price. This includes title fees, appraisal fees, and insurance premiums.

What is the first step in buying a home?

The first step in your home-buying journey is to reach out to a professional. Whether it's a realtor or a lender, initiating that conversation is key.

- Get Pre-Approved: Before you start shopping for homes, understanding how much you can afford is essential. This will help you set realistic expectations and avoid disappointment.

- Define Your Goals: Discuss what you're looking for in a home, such as location, size, and budget. This clarity will help your agent find the best options for you.

- Begin Your Search: Once pre-approved, you can start exploring listings that fit your criteria.

What credit score do I need to buy a home?

Credit scores play a significant role in determining your eligibility for a mortgage. Different loan types have varying requirements:

- Conventional Loans: Generally require a minimum score of around 620.

- FHA Loans: Can go as low as 580 with a minimum down payment.

- VA Loans: Do not have a strict credit score requirement, but having a score in the 600s is advisable.

If you have no credit at all, you may still qualify for a loan through non-traditional credit methods, such as providing evidence of timely rental payments or utility bills.

Where Jacob and I currently are?

Jacob and I are currently in the midst of a dynamic real estate market. We see fluctuations in demand and supply, which can affect pricing. It's essential to stay updated on market trends to make informed decisions.

We are actively engaging with buyers and sellers, ensuring they have the latest information. This allows us to provide tailored advice based on their unique situations.

Our focus is also on understanding the needs of our clients. By doing so, we can better assist them in navigating the complexities of buying or selling a home.

Can you use your VA loans more than once?

Yes, VA loans can be utilized multiple times, which is a common misconception. Many veterans and active-duty service members are unaware that they can reuse their VA loan benefits.

It’s crucial to understand how the entitlement works. If you have paid off your previous VA loan, your full entitlement is restored, allowing you to access another VA loan for your next home purchase.

Even if you still have an outstanding VA loan, you may still qualify for another one, provided you have enough remaining entitlement. This flexibility is one of the many advantages of VA loans.

- Restoration of Entitlement: After paying off a VA loan, entitlement is restored.

- Remaining Entitlement: If you have an existing VA loan, check your entitlement status.

- Use for Investment Properties: VA loans can also be used for purchasing multi-unit properties.

Common Misconceptions About Closing Costs

Many buyers have misconceptions about closing costs, often overestimating or underestimating what they entail. Understanding these costs is crucial to avoid surprises.

Closing costs typically include various fees such as appraisal fees, title insurance, and attorney fees. Many believe these costs are negotiable, which can lead to confusion.

In reality, some costs are set by the lender or local regulations, while others can be negotiated. It's essential to ask your lender for a breakdown of all anticipated costs early in the process.

- Percentage of Purchase Price: Commonly, closing costs range from 2% to 5% of the home's purchase price.

- Prepaid Costs: These may include property taxes and homeowners insurance, which are often included in the closing statement.

- Negotiable Fees: Some fees, like the lender's origination fee, may be negotiable, so don't hesitate to ask.

FAQ

What should I ask my lender?

When working with a lender, consider asking the following questions:

- What types of loans do you offer, and which is best for my situation?

- What are the current interest rates, and how do they compare to the market?

- What are the estimated closing costs, and can you provide a breakdown?

How can I improve my credit score before buying a home?

Improving your credit score can enhance your mortgage options. Here are some strategies:

- Pay your bills on time to establish a solid payment history.

- Reduce your credit card balances to lower your credit utilization ratio.

- Check your credit report for errors and dispute any inaccuracies.

Is it necessary to have a home inspection?

A home inspection is highly recommended. It can uncover potential issues that may affect your purchase decision or future expenses. A thorough inspection can provide peace of mind and help you negotiate repairs with the seller.

What is the best time to buy a home?

The best time to buy a home often depends on market conditions. However, many agree that the spring and summer months typically offer more inventory. Conversely, purchasing in the fall or winter may provide better deals as competition decreases.

Buying a house is one of life’s most exciting milestones, but navigating the process requires the right knowledge and support. Let Aundrea Dudik be your guide to Central Texas Real Estate! With expert insights, personalized advice, and a deep understanding of the market in Temple, Belton, and Morgan’s Point, I’m here to make your home-buying journey smooth and rewarding.

Don’t wait—your dream home in Central Texas is just a step away!

Central Texas Real Estate, led by Aundrea Dudik, is your trusted partner for buying and investing in homes across Temple, Belton, and Morgan’s Point, offering expert insights, personalized guidance, and a deep understanding of the Central Texas real estate market to help you find the ideal Texas home for sale that matches your lifestyle in this thriving region.

Aundrea Dudik

With over 150 clients served in Central Texas real estate, Aundrea helps her buyers navigate relocating seamlessly. Known for her expertise, she has a lot of valuable insights on her YouTube channel to make moving to Central texas a hassle-free experience.